In today’s environment of heightened pressure on nonprofit budgets, program demands, and donor expectations, many organizations turn to mergers as a path toward greater scale, sustainability, and impact. Yet the outcome of a merger is far from guaranteed. A failed nonprofit merger can carry hidden costs that erode value, weaken governance, disrupt culture and programs, and undermine donor confidence. For executives, board members, financial managers and legal advisors supporting nonprofit strategy, understanding these risks—before they become reality—is critical.

This article draws on two decades of consulting with nonprofits undergoing transformational change. We explore the hidden costs of failed nonprofit mergers, highlight where the real risks lie around nonprofit merger costs, nonprofit merger risks, nonprofit merger integration and nonprofit merger challenges, and provide an actionable roadmap for how to avoid them. The goal: empower your team to navigate a strategic merger (or choose an alternative) with clarity, rigour and mission focus.

Table of Content

What Makes a Nonprofit Merger Fail?

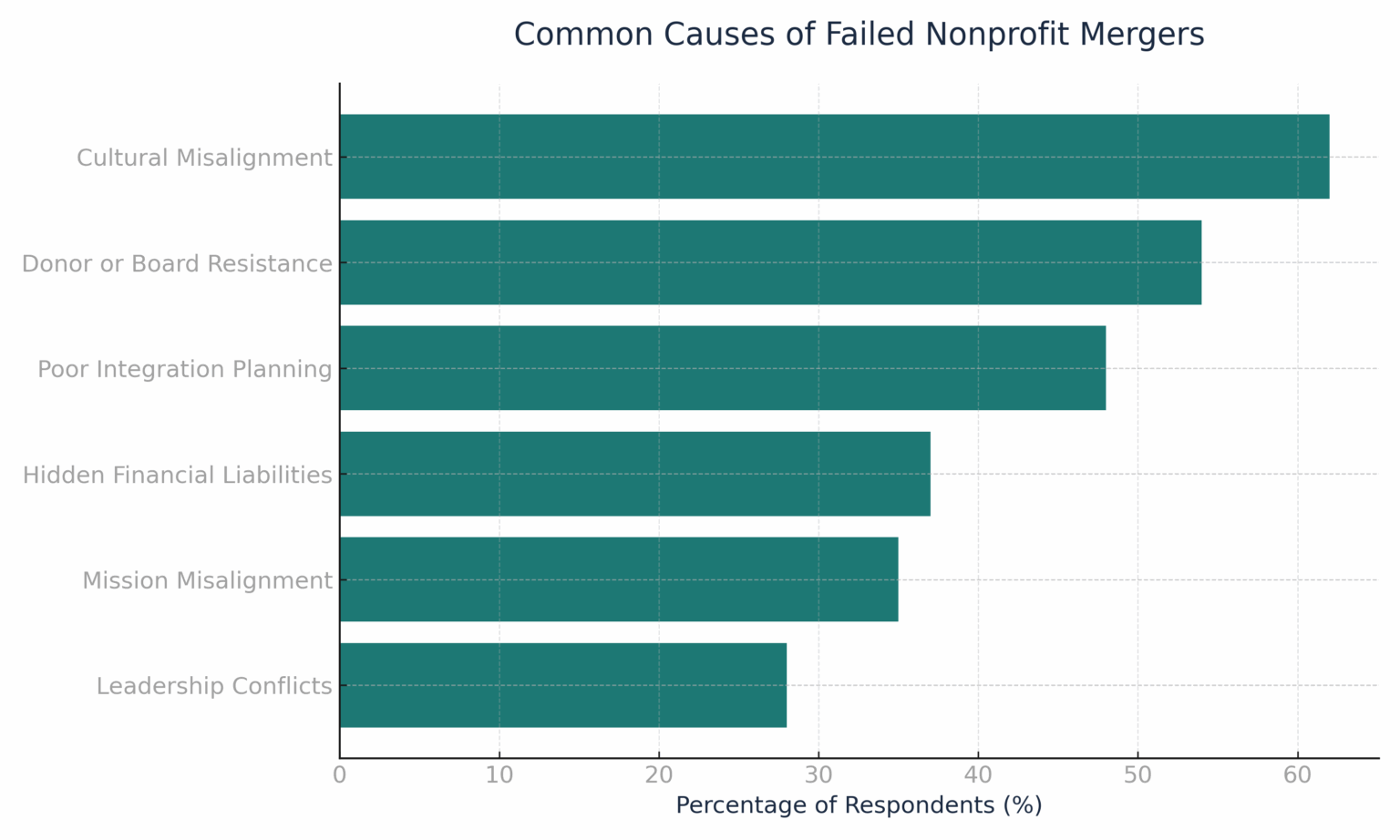

A merger between nonprofits isn’t simply a legal or structural exercise; it’s a profound organisational change that impacts finances, culture, governance, identity and mission delivery. When one or more of these elements are insufficiently addressed, the result is a merger that falls short of expectations—or worse, undermines the combined entity. Some of the frequent failure triggers include:

Insufficient due-diligence: Merger partners may overlook or underestimate liabilities, contractual obligations, regulatory exposures or debts, leaving the surviving entity vulnerable.

Mission and identity misalignment: When the organisations involved have divergent values, programmatic priorities or community perceptions, the merger may feel like a compromise rather than a unity of purpose.

Under-estimating cultural integration: Staff, leadership and stakeholders often resist changes in leadership style, operating systems, branding or identity. High turnover, disengagement and productivity loss are common.

Stakeholder disengagement: Donors, board members, community partners or beneficiaries may feel excluded or disaffected by the process, leading to withdrawal of support, reduced donations or reputational harm.

Weak integration planning: Without a deliberate integration roadmap (governance, HR, IT, operations, brand, programs), the day-to-day disruptions multiply. Delays, confusion, duplicated systems, or conflicting leadership emerge.

Inflated assumptions of “synergy” and underestimated costs: Leaders often assume cost-savings or increased impact will flow automatically. In reality, up-front costs, hidden liabilities, transition expenses and revenue disruptions can offset the benefits.

When these issues align, what appears on paper to be a logical “strategic merger” becomes a source of hidden nonprofit merger costs — financial, human-capital and reputational.

Source: Stanford Social Innovation Review, 2022.

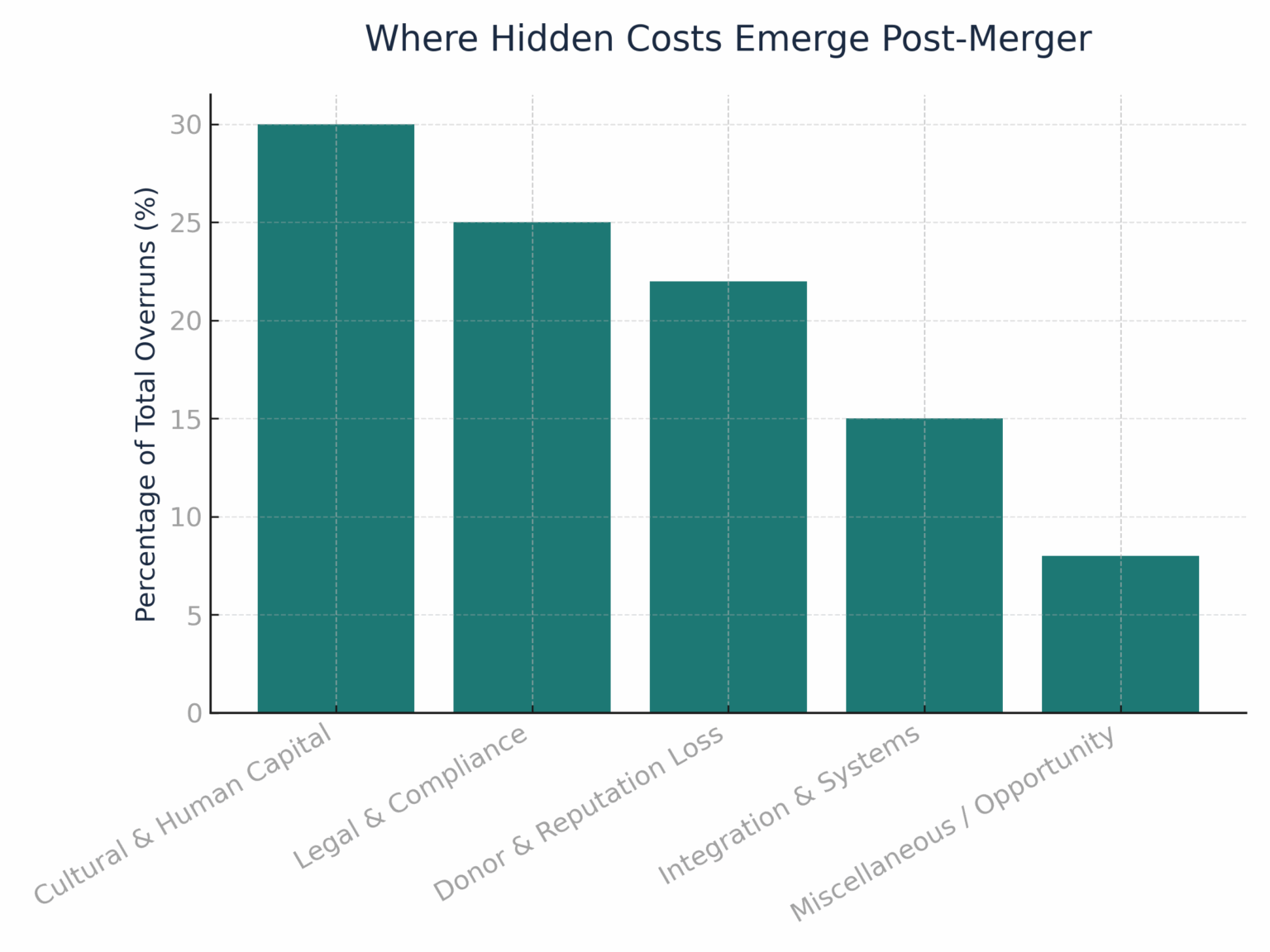

Let’s explore the major cost categories in more depth—because many of these are not obvious at the outset of planning, yet they represent significant drains on value.

Undiscovered Liabilities

One of the most dangerous aspects of a failing merger is the assumption of hidden debts, unresolved legal or compliance issues, and the long tail of contractual obligations. For example: legacy lawsuits, leases or property issues, unresolved programmatic deficits or environmental obligations. When these emerge post-merger, the merged organisation inherits not just assets but liabilities that can strain cash flow, reduce reserves and distract leadership.

Loss of Donor and Board Support

A merger announcement or leadership restructuring often spooks key donors or board members, especially when the mission or brand is changed. If longtime supporters feel their relationship is being disrupted, they may withdraw funding, decline to renew commitments, or simply disengage. Similarly, board attrition or resistance can undermine governance and oversight, increasing risk for the merged entity.

Cultural and Identity Conflicts

Even with financial fit, a merger often fails because of the human side. Differences in leadership styles, organisational culture, decision-making norms or informal power structures can lead to staff dissatisfaction, turnover of top talent, loss of institutional knowledge, and operational drag. The merged team often spends more time reconciling systems, legacy processes or identities than driving the mission.

Brand and Program Disruption

If the merger requires a new brand, or a shift in programmatic priorities, community partners or beneficiaries may feel “abandoned” or “swallowed up,” particularly if the merging organisations had distinct identities. That can result in reduced community trust, less efficient recruitment of volunteers or beneficiaries, donor confusion, and ultimately decreased impact. Legacy programs might be cut or diluted, eroding the very reason the organisation existed originally.

Legal and Contractual Issues

Merging nonprofits must contend with complex legal and contractual obligations: employment agreements, union contracts, grants, regulatory filings, tax‐exempt status issues, provider licenses, property leases, and so forth. Missing a key step—such as failing to obtain a private letter ruling on IRS tax status or overlooking an accreditation contract—can result in compliance costs, penalties or even loss of tax-exempt status. These are among the hidden nonprofit merger risks many boards overlook.

Opportunity Costs and Strategic Drift

Merger processes consume significant leadership attention, staff time, Board focus and operational bandwidth. If less emphasis is placed on day-to-day programs or fundraising, the merged organisation may suffer revenue declines, service disruptions, or loss of innovation. Meanwhile, if integration drags on without clear strategic focus, the “new entity” may drift from its original mission, reducing stakeholder confidence and impact.

Quantification Table

Here’s a summary table illustrating primary hidden cost categories and corresponding prevention strategies:

Category

Hidden Costs & Risks

Key Prevention Strategies

Financial & Legal

Assumption of hidden debts/liabilities; high transaction costs (legal, consulting); potential tax-exempt status issues

Conduct exhaustive due-diligence; secure private IRS letter ruling on tax status

Cultural & Human Capital

Culture clashes and leadership conflicts; loss of key staff/institutional knowledge; employee disengagement & legal claims

Assess and align organizational cultures early; manage integration with transparency and empathy

Stakeholder & Reputational

Loss of donors due to changed mission/identity; weakened branding/public perception; opposition from board/community

Engage donors/board early; build unified board; communicate clear vision

By articulating these hidden costs ahead of time, you can better negotiate, plan and allocate resources—and thus reduce the likelihood of becoming a statistic in the “failed nonprofit merger” category.

Source: Nonprofit Finance Fund (NFF) 2023 Financial Health Survey; National Council of Nonprofits, 2022.

Why Integration Planning Matters (And Often Fails)

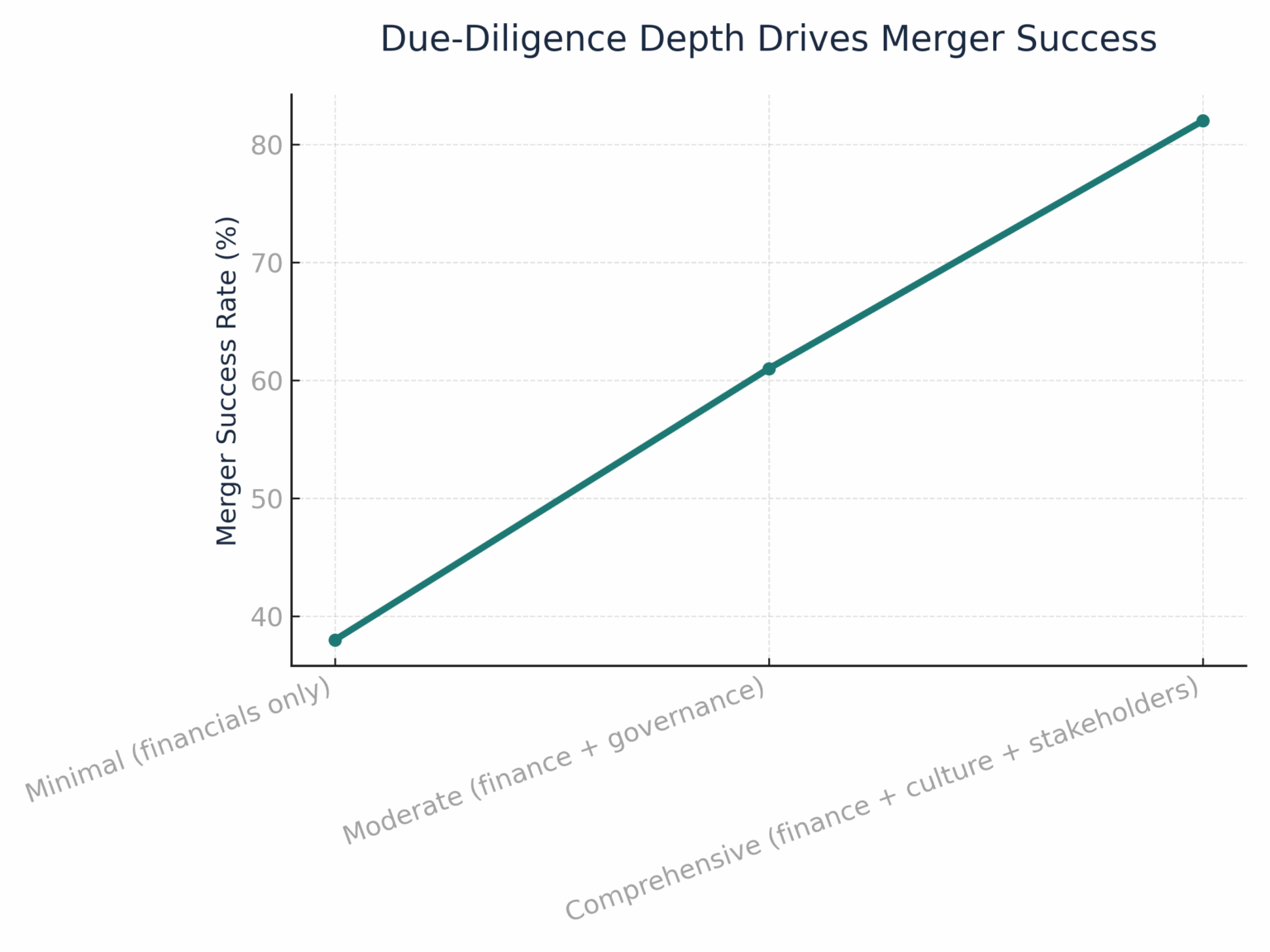

Too often in nonprofit mergers, the integration phase is treated as an afterthought. Yet it is in this phase where the majority of the tangible and intangible costs begin to accumulate. Experts emphasise that integration planning and due-diligence are deeply connected.

Here are the key integration areas where failures tend to emerge—and how you can plan ahead:

Cross-functional integration team: Assemble representatives from finance, operations, HR, IT, programs, and communications. If you wait until after the merger is approved, you’ll lose time and momentum.

Systems & processes alignment: Disparate accounting platforms, donor databases, HR policies, grant tracking or IT environments can cause costly delays and frustration. Integration should include an inventory of systems pre-closing and a roadmap for harmonisation.

Brand, culture and identity transition: As noted above, cultural clash and staff turnover are major hidden costs. A best practice is to address culture from Day One: create cross-organisation workshops, jointly define values, identify “cultural champions,” and actively manage the new identity.

Communication strategy: Transparent and frequent communication with staff, board, donors, community partners and beneficiaries is critical. Uncertainty is the enemy of engagement.

Milestones, metrics and timelines: Like any major project, a merger needs clear integration checkpoints, success metrics (e.g., donor retention %, staff turnover %, program retention, cost-savings achieved) and accountability. Without this discipline the process drifts and costs mount.

Post-merger review and adjustment: Integration is not “done” at closing. Many issues only surface months into the combined operation—monitoring and adaptation are essential.

When integration is treated as a core strategic component (not just the “plumbing”), you significantly reduce the risk of hidden nonprofit-merger-integration costs.

The Cost of Failure – Realistic Scenarios

Consider a hypothetical but realistic scenario for a mid-sized nonprofit merger:

Organization A merges with Organization B. Pre-closing, due diligence missed a pending lawsuit (Organization B), a 5-year lease obligation, and a donor segment that opposes the merger identity change.

Post-merger: Donations from that donor segment decline by 20 % in year one. Staff turnover from program teams rises by 15 %. Integration of IT/donor systems is delayed by six months, causing duplication of effort and confusion. Management spends significant time addressing cultural issues rather than fundraising or programs.

Costs incurred: Legal settlement + lease exit penalty ($250k) + increased HR/turnover cost ($150k) + lost donations ($300k) + delayed cost-savings from synergies ($200k).

Outcome: Instead of achieving the targeted cost-savings in year one, the organisation sees a net negative impact of $900k. The board questions the strategic rationale, and community partner trust is shaken.

While this is a simplified illustration, it shows how cumulative hidden nonprofit merger costs can quickly overshadow anticipated benefits.

How to Avoid Failed Nonprofit Mergers

Going back to fundamentals: successful nonprofit mergers aren’t the result of luck—they’re the outcome of rigorous planning, proactive management, transparent communication and careful integration. Here are the key steps:

Rigorous Due Diligence

Review financial statements (past 3–5 years), audited reports, management letters, contingent liabilities.

Examine all contracts and leases, employment agreements, intellectual property, programmatic grants and obligations.

Review board minutes, governance structure, compliance/regulatory history, accreditation/licencing.

Evaluate culture: leadership styles, staff turnover history, operating norms, decision-making practices.

Assess mission and values alignment—does the partner share equivalent purpose, reputation, community perception?

Engage independent counsel and financial advisors to ensure transparency and unbiased assessment.

Source: La Piana Consulting “Mergers as a Strategy for Growth,” 2020

Mission & Values Alignment

Mergers succeed when the combined entity can credibly articulate a unified mission. Board and leadership teams must believe in that mission. Ask:

Is the merger driven by strategic choice or operational desperation?

Will the merged brand remain authentic to stakeholders and communities served?

- Ensure both boards and leadership teams are aligned to amplify—rather than dilute—the combined mission.

Are both organizations willing to compromise areas of control, or will one dominate? A “merger of equals” sounds appealing, but true equals are rare in practice; clarity is better than illusion.

Build Internal Support

Engage boards, senior leadership and staff early. Create a merger committee with members from both organisations.

Develop a clear communications plan for staff, identifying how roles, reporting lines, and culture will evolve.

Offer forums for staff questions and concerns. High-turnover during mergers is often from new role uncertainty or perceived loss of identity.

Engage External Stakeholders

Communicate proactively with donors, funders, beneficiaries, community partners—even before the merger vote. Frame the rationale clearly and authentically.

Ask major funders early if they have concerns about identity, governance, or mission change. Donor withdrawal is a hidden nonprofit merger risk.

Public brand messaging should emphasize continuity of mission, benefit to stakeholders, and how programs will strengthen, not weaken.

Plan for Cultural Integration

Invest in culture-integration workshops, joint leadership retreats, staff cross-visits. Recognize that culture change is real work, not just “plumbing”.

Define and communicate the new organization's values, behaviors and how legacy identities will be honored or transitioned.

Establish “quick wins” to build momentum and organizational confidence. Early programmatic success reduces anxiety.

Focus on Long-Term Strategic Value

Treat the merger as an investment in future mission impact—not merely a cost-savings exercise. Set measurable outcomes (e.g., service-delivery growth, geographic expansion, cost-efficiency improvements) and monitor these post-merger.

Keep maintaining day-to-day operations during transition. Don’t allow merger distraction to undermine programs or fundraising.

Maintain governance vigilance: a unified board with clear roles and oversight ensures accountability during integration.

Prepare to Exit or Choose Alternatives

Finally, recognize that merger is not the only option. If the numbers, culture or stakeholder alignment aren’t right, consider other options such as consolidations, parent-subsidiary arrangements, joint ventures, or simple programmatic partnerships. A forced merger with insufficient fit almost always imposes hidden costs. Know when to walk away.

Checklist: Pre-Merger Readiness & Risk Mitigation

Here is a practical checklist to guide your governance, leadership team and advisors:

Have both Boards adopt “merger readiness” as a strategic priority.

Commission an independent due-diligence review covering: finance, legal/compliance, contracts/leases, human capital, IT systems, program evaluation, culture alignment.

Conduct a mission/values alignment workshop with leadership from both organisations.

Identify and map key stakeholders (donors, funders, board members, community partners) and design a communications plan.

Build an integration steering team with representation across functions (finance, HR, programs, tech).

Develop a detailed integration plan with milestones, responsibilities, metrics (e.g., donor retention, staff turnover, cost savings achieved, program continuity).

Design a brand transition strategy (decide on name, identity, messaging, how legacy brands will be honoured).

Conduct scenario planning: what if donor X leaves, or key staff resigns? What backup plans exist?

Monitor time and leadership bandwidth: are key leaders being pulled off mission-critical work? Make sure the operational engine keeps running.

Schedule post-merger review at 3, 6, 12 months to assess integration progress, stakeholder feedback, financial outcomes and course correct as needed.

Conclusion

Successful nonprofit mergers demand careful planning, cultural sensitivity, and proactive management of both tangible and intangible risks. For nonprofit executives, board members, financial and legal advisors working in governance or strategy, the stakes in a merger decision are high. When planned and executed with rigour, a merger can indeed strengthen a nonprofit’s capacity, expand impact and improve cost-efficiencies. But when the risks—nonprofit merger risks, integration blind spots, culture misalignments and hidden nonprofit merger costs—are unaddressed, the outcome can be a failed nonprofit merger that erodes value, mission and trust.

In your next merger discussion ask: • Have we identified the hidden costs? • Do our Boards speak the same language about mission, values and future? • Is there an integration plan ready today, not months after closing? • Are key donors, staff and stakeholders aligned and supportive? • Do we have clear metrics and accountability?

By focusing on these questions early and deeply, you create the best possible foundation for success—and avoid the consequences of being part of the statistic of failed nonprofits mergers.

Found this post useful? Feel free to share.

Let Glick Davis & Associates Assist You in Your Nonprofit Mergers.

Frequently Asked Questions

Risks include assuming hidden liabilities, losing donor support, cultural misalignment, operational disruption, and failing to deliver the anticipated cost-savings or program benefits. These hidden risks often stay hidden until after closing.