Nonprofit mergers can be transformative, enabling mission-driven organizations to expand their reach, share resources, and improve long-term sustainability. Yet unlike corporate acquisitions, nonprofit M&A (mergers and acquisitions) is not about profit maximization—it is about maximizing impact. Successful nonprofit mergers require careful planning, transparent communication, and deep alignment around mission and culture.

For nonprofits and healthcare organizations, understanding the lessons learned from successful nonprofit mergers can mean the difference between a merger that strengthens your mission and one that derails progress. In this article, we’ll explore nonprofit merger best practices, common challenges, and proven strategies from real-world cases to help leaders make informed, strategic decisions.

1. Align Missions and Values

Mission alignment is the cornerstone of every successful nonprofit merger. When organizations share similar values and purpose, the combined entity strengthens its ability to serve its community. Conversely, when missions diverge, conflict and confusion often follow.

A merger should never dilute your mission—it should amplify it. Both boards and leadership teams must ask:

Does this merger advance our shared vision?

Will the combined mission strengthen outcomes for our beneficiaries?

How do our core values align?

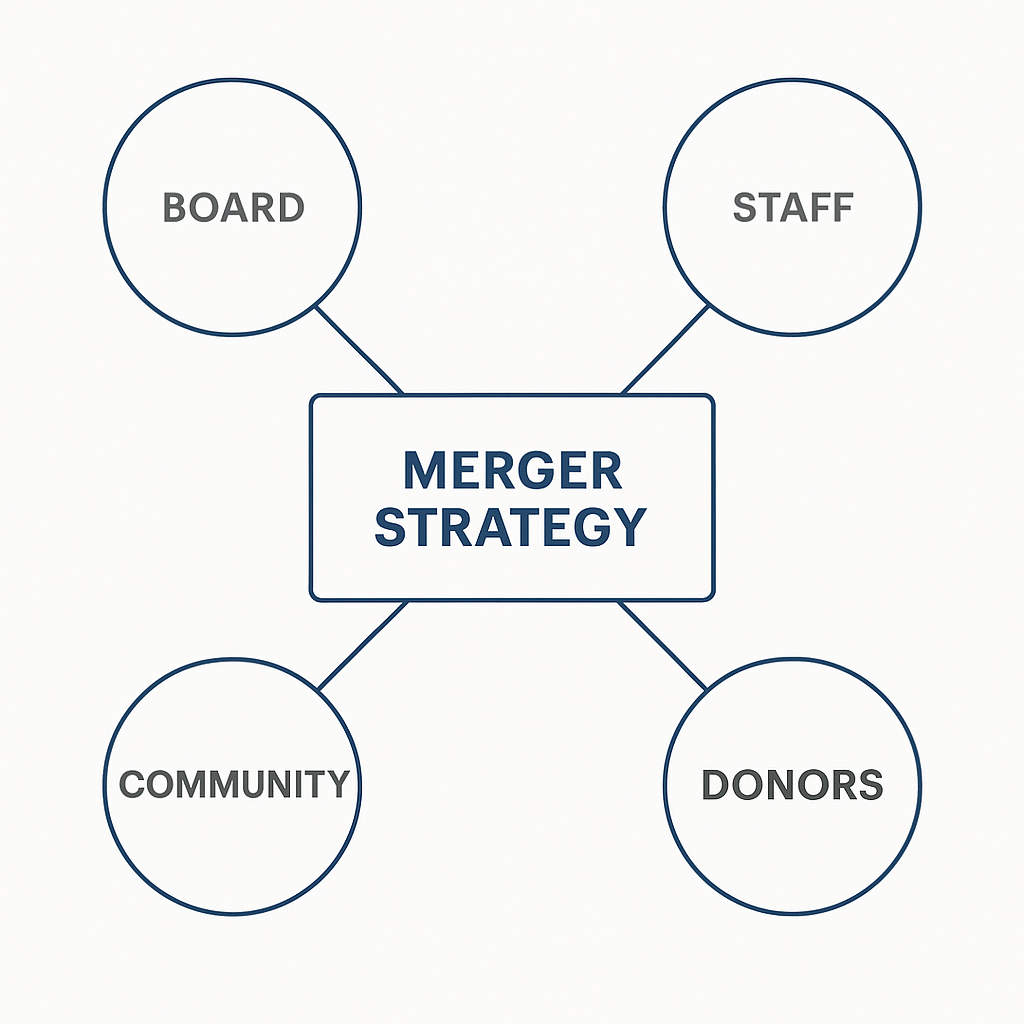

2. Build Strong Internal Support

Even the best strategic plan will fail if the people inside the organization don’t believe in it. A nonprofit merger is not just a financial or operational process—it is an emotional journey for staff, boards, and volunteers.

Best practices include:

Forming merger committees with representation from both boards.

- Building trust and leadership buy-in

Hosting joint leadership retreats to build trust.

Engaging staff in structured discussions to address concerns.

Providing clear, honest communication to prevent rumors.

When staff and leadership feel ownership in the process, they are more likely to champion the change rather than resist it.

3. Engage Stakeholders Early and Often

Funders, donors, beneficiaries, and community partners must be engaged early in the process. Transparency builds trust and helps secure financial support for the merger, which often involves upfront costs such as legal, consulting, and system integration expenses.

Engagement strategies:

Confidential early conversations with major funders.

Open forums for community partners and beneficiaries.

Frequent board and staff updates via newsletters or town halls.

Case Insight: Research shows that 80% of successful nonprofit M&A efforts included significant pre-merger collaboration, which built trust and credibility with stakeholders before the merger was finalized.

4. Leverage Complementary Strengths

The strongest nonprofit mergers occur when organizations bring complementary—not identical—strengths to the table. For example, one nonprofit may have deep community trust, while the other has robust operational infrastructure. Together, they can deliver more effective, scalable impact.

Ask yourself:

What unique expertise does each organization bring?

How can resources, networks, or technology be combined for greater reach?

Where do the organizations overlap, and where do they complement?

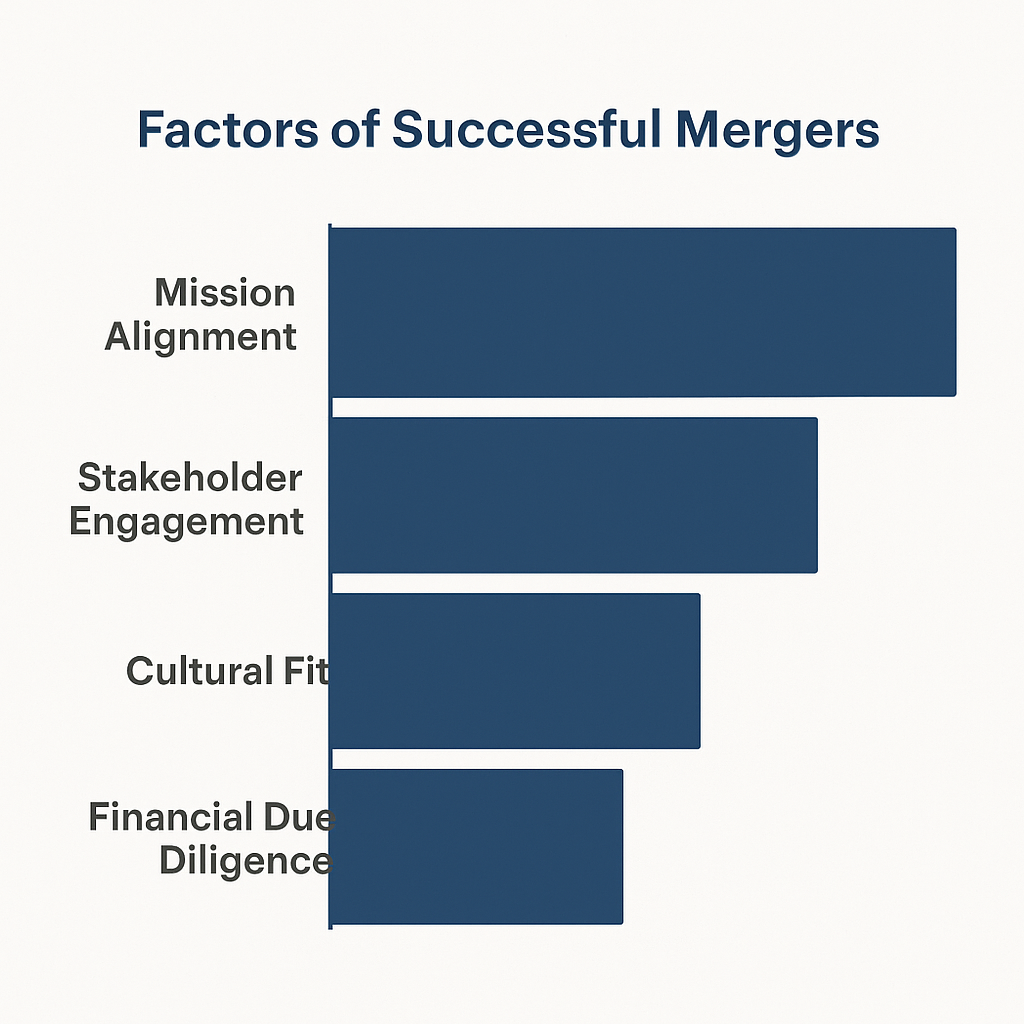

5. Conduct Rigorous Due Diligence

Nonprofit leaders often underestimate the financial and legal complexities of mergers. Skipping due diligence can create post-merger surprises that drain resources and erode trust.

Due diligence should cover:

Assets and liabilities

Contracts and grant obligations

Employment agreements

Compliance and legal risks

Technology systems and data

Independent legal and financial counsel should guide this process to ensure objectivity and transparency.

6. Plan for Cultural and Operational Integration

Many nonprofit mergers fail not because of financial missteps, but because of cultural clashes. Leadership styles, decision-making processes, and even the pace of work may differ.

Best practices include:

Hosting cross-staff workshops to understand differences.

Aligning HR policies and benefits early.

Standardizing technology systems.

Clarifying reporting lines and board structure.

Hiring an outside consultant to facilitate cultural integration can prevent misunderstandings and provide a neutral perspective.

7. Take a Long-Term, Strategic View

A merger is not a short-term rescue plan—it’s a strategic investment in the future. Define clear long-term goals, success metrics, and a unified strategic plan.

Ask:

What measurable outcomes should we achieve in 3–5 years?

How will this merger expand our impact on the communities we serve?

What does sustainability look like post-merger?

Mergers framed as survival tactics often fail. Those framed as future-oriented strategies thrive.

8. Communicate Throughout and After the Process

Communication is not just for the merger announcement—it must continue long after the legal documents are signed. Transparency builds confidence with staff, stakeholders, and funders.

Recommended practices:

Ongoing newsletters with integration updates.

Community-wide announcements of impact milestones.

Joint branding strategies to reinforce unity.

When communication lapses, stakeholders may assume problems. Consistency builds trust.

Key Takeaways

Mission alignment is the foundation.

Internal support ensures smoother transitions.

Stakeholder engagement builds trust and secures funding.

Complementary strengths create new opportunities.

Due diligence protects against hidden risks.

Cultural integration prevents operational breakdowns.

Long-term vision frames the merger as growth, not survival.

Ongoing communication sustains confidence and impact.

Nonprofit M&A should never feel like a takeover. Instead, it should represent shared benefits, mutual respect, and collective strength.